Blogs & News

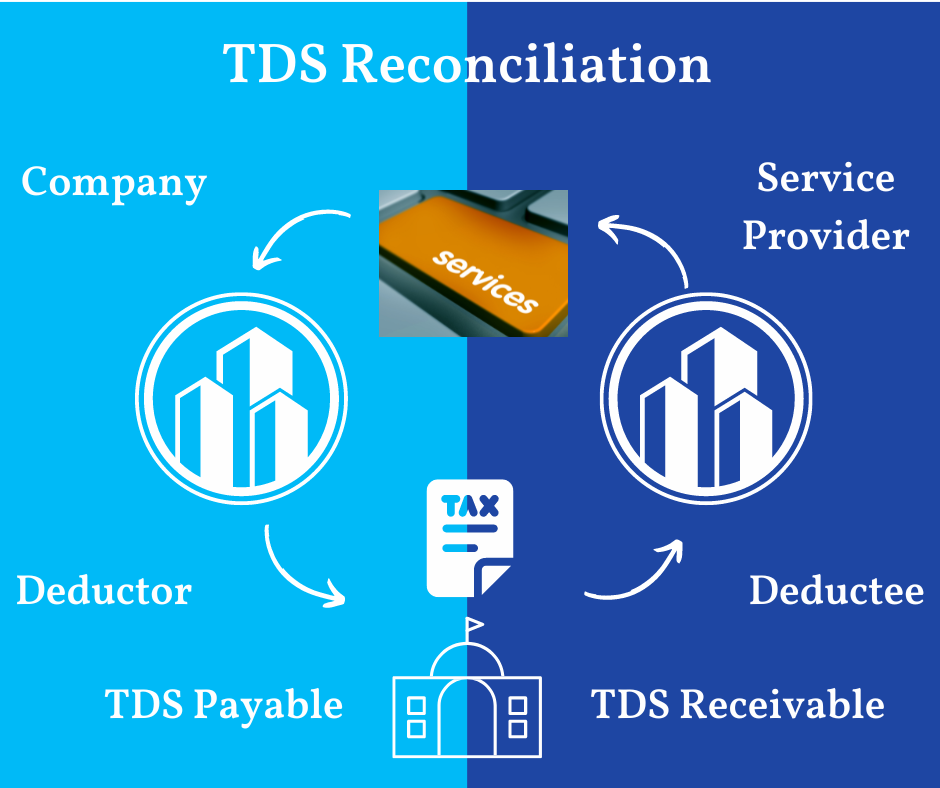

Why automate TDS Receivable Reconciliation?

What is TDS? TDS or “Tax Deducted at Source” is a form of withholding tax introduced to collect tax from the very source of income in India. A person or company who has to make payment for a specified service/product to any other person or company has to deduct tax...

Read MoreCategories

Why automate TDS Receivable Reconciliation?

What is TDS? TDS or “Tax Deducted at Source” is a form of withholding tax...

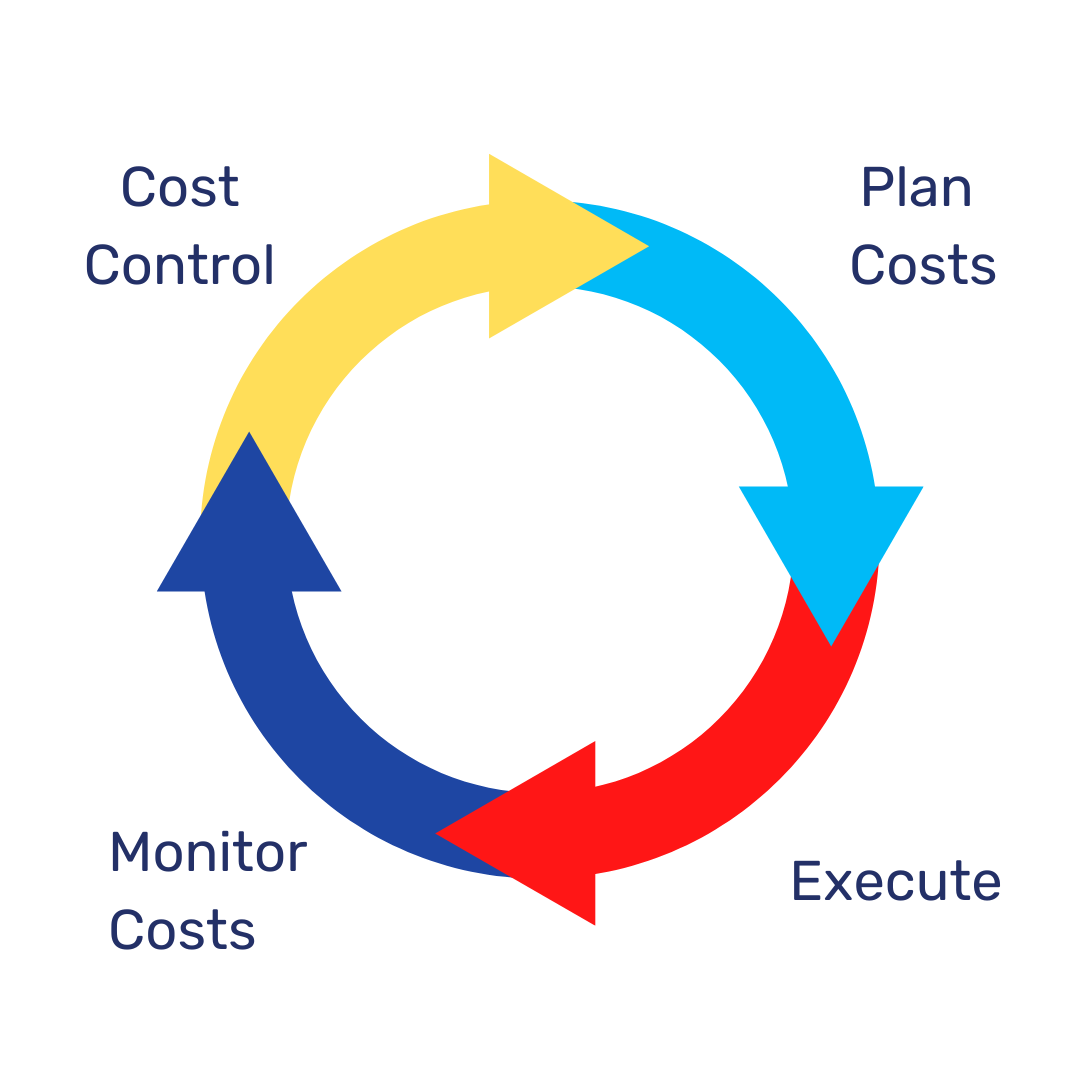

Read More2024 Guide to managing and controlling costs –

Importance of managing costs It is a continuous endeavor among you, the finance teams to...

Read MoreA NEW APPROACH TO ACCOUNTS PAYABLE

Towards the end of my journey @ my previous company, we tried solving one of...

Read MoreA FINANCE FUNCTION’s NEW APPROACH TO LOW RISK

Over the last few decades, the role of the CFO has undergone a profound shift....

Read MoreFAQ

Frequently Asked Questions

Definitely. DataTwin has a Import tool that helps you map your data in excel, csv, tsv etc. to the internal data model. Once mapped, the import can be done without any issues. The mapping can be stored as a theme and can be changed when the importing data formats changed.

As many as you want. There are no restrictions on the number of themes you can create.

DataTwin provides a set of interfaces that are based on REST API’s and can transact based on JSON. If there is a specific need to integrate with an ERP, it can be taken up as part of the Set-Up or service efforts at a small cost to ensure your utilistation is utmost and derive maximum benefits from DataTwin.

Extracting information from a vendor bill, accounting for the bill, allocation of costs for that bill, approvals for the bill are all automated. As part of period end activities, for any PO/Internal Plan created but no goods receipt or service receipt received, provision is automatically made and posted. Also amortization of prepaid bills periodically is automated. Taxation in terms of GST and Withholding tax has been automated.